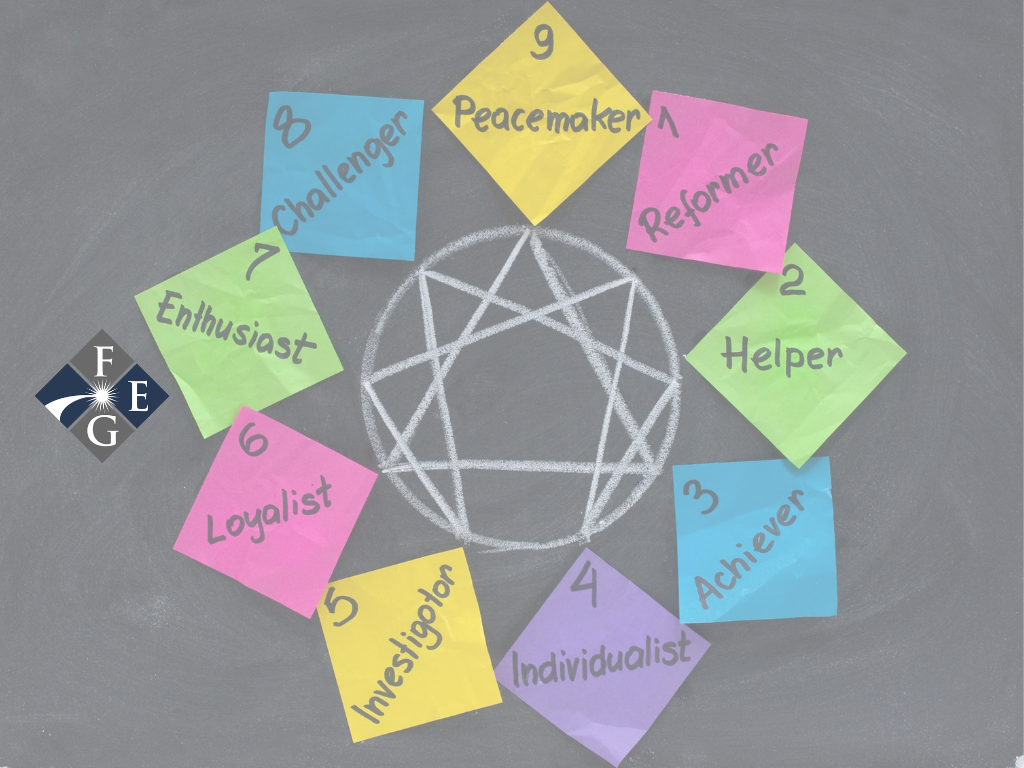

This year I introduced my family to the Enneagram. The last 52 years of life seem to have come to pass without a moment's recognition of this wonderful tool. The Enneagram is believed to be a 2,000-year-old tool that explains from a personality perspective who we are and helps us retrieve why we are. This reminds me of the verse by the Apostle Paul found in Romans 7:15 “I do not understand what I do. For what I want to do I do not do, but what I hate I do.” NIV version. Pretty much sums it up!

The Enneagram has challenged me to know my behaviors. The Enneagram has certainly helped with my closest relationships, but it has also helped me in business and investing. The idea behind knowing how you will respond to a situation before the occurrence is more helpful than you might think.

People tend to go through life believing that most situations are “one-off” issues occurring at random times and are anything but predictable. The reality is that most decisions we make have a “root” or baseline drive that has us react the same way in similar settings. Most of us tend to react rather than respond to a situation. Knowing your tendencies can help you learn to respond rather than react, which will always be better for your financial and emotional future.

There isn’t enough ink in the entire paper to discuss the Enneagram in total, but this article will turn to how knowing yourself can protect you from making poor decisions regarding your investments. For the inquisitive minds who know the Enneagram, I am an 8 with a 7 wing.

If you work with an investment professional, there is a good chance you took a risk tolerance quiz. The quiz is designed to ask you about your objectives which do change over time, but it also asks how you would behave in a crisis.

The quiz is critical for helping your Fiduciary advisor (which is often you) make the best decisions for your money. Remember that a Fiduciary is obligated to treat your money as if it were their money, and they were in your situation. Always ask if your advisor is asking in a Fiduciary capacity when talking about your investments.

One thing I am a big believer in is the genesis of any project, investment, and relationship. When a decision is made to do something or not do something, I try to record it in my journal for future reference. It is so very easy to focus on only the good decisions we have made in times of good. The reverse is true in times of crises like 2008-09.

Knowing your previous behavior patterns helps you guide your emotions when things don’t go as expected. Write down why you made every investment decision. It will be good for you and for others that may have to make investment decisions on your behalf in the future.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see our Disclosure page for the full disclaimer.