James Clear, the author of “Atomic Habits,” always says, “Success is never dependent on one thing, but failure can be.” That has never been truer than with financial planning. When we talk about planning for retirement, the conversation usually goes in the same direction, investment returns. Although investment returns are a factor in your financial plan, we can argue that it is not the most imperative for success.

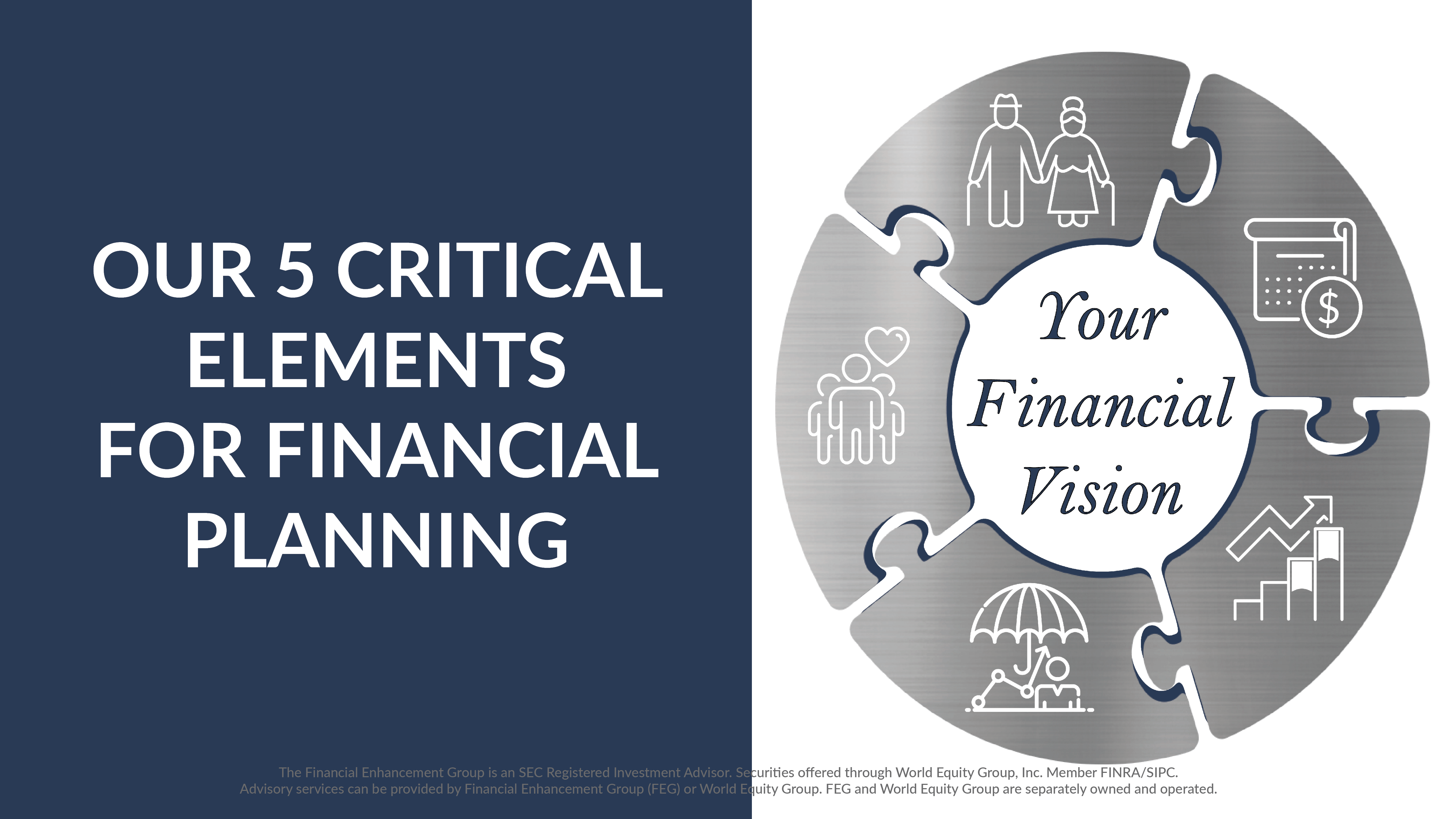

Just as a farmer would not make a critical decision without considering the entire farming operation, you should not make a decision regarding your finances without taking a step back and seeing the big picture. We have identified five areas of planning, what we call The 5 Critical Elements, that if not addressed properly will leave you with a plan that is likely to fail.

“Your Life After Work” is really taking a step back and determining what your life will look like once you have decided it’s time to retire from your career. This looks different for everyone! Some may decide to work part-time at a job more in line with their passion while others may spend their newfound time with their grandkids or traveling. It is imperative to make sure your financial plan is in line to reflect the goals that you have for retirement.

“Tax Planning” is an area that no one really wants to talk about, but if it is missed or ignored, you could be spending your future answering to Uncle Sam. If Tax Planning is given the proper attention, you will give yourself more flexibility to take the income you need to uphold your standard of living while being able to control how much money you are sending to the government in the form of taxes. Although it is not a popular topic, it is arguably one of the most important planning areas to set yourself up for success.

“The Investment Playbook” is, as it says, making the right call for how your assets should be invested based on where you are in life. If you are making this decision based off of your age, it is important to discuss why this isn’t the best strategy.

“Risk Management and Life Issues” is the good, bad, and ugly of life. One of the most important topics that we must discuss is planning for the loss of a spouse. It is a sad reality of life, that if not planned for properly, can add even more heartache to an already devastating situation.

Finally, we have “Legacy Planning.” No one plans to leave an inheritance to their loved ones thinking that it is going to adversely affect them. It is important to understand why not all beneficiaries are equal. It is also imperative to have a plan in place to protect yourself and your loved ones while you’re still living.

These 5 Critical Elements encompass an incredible amount of planning. Make sure your financial plan addresses each area, so you are not leaving yourself susceptible to frustration and devastation in your future.

The Financial Enhancement Group is an SEC Registered Investment Advisor. Securities offered through World Equity Group, Inc. Member FINRA/SIPC. Advisory services can be provided by Financial Enhancement Group (FEG) or World Equity Group. FEG and World Equity Group are separately owned and operated.