[vc_row][vc_column width=”1/4″ offset=”vc_hidden-xs”][vc_widget_sidebar sidebar_id=”sidebar-main”][/vc_column][vc_column width=”3/4″][vc_column_text]

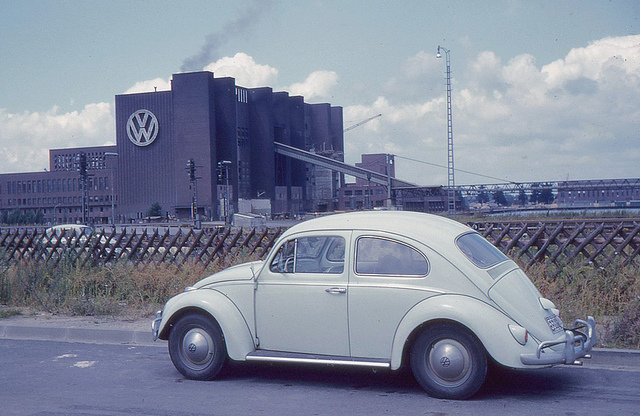

This has been a tough week for Volkswagen. The company shed more than a third of its market capitalization at one point during the week and the CEO resigned. A short-term mentality resulted in the company lying to U.S. and European regulators about emissions issues. Does this lapse in ethical decision making justify such a sharp decline in the company’s stock price? Perhaps.

Many investors, our team included, will shed a stock over any accounting irregularity. If we cannot follow the income and cash flow, then we can’t correctly determine the appropriate price for a given stock. We have sold shares of companies with “issues” and watched their prices soar even higher. We have also seen them crash — hard. Investing in “issues-laden” companies is a risk that we are unwilling to take. When the investment community sees one of the world’s largest manufacturers enmeshed in a scandal of this magnitude, establishing a fair price for the stock is difficult.

So what happened? While all the details aren’t readily available, it’s safe to assume that management focused on current earnings rather than building corporate value. Rather than focus on the hard and often boring executive activities that drive a company’s value, the corporate titans got swept up in the frenzy of day-to-day pricing. Under this mindset, bad if not illegal decisions were inevitable.

Working with several private companies, our team admires how quality management teams act, respond and grow their business when they aren’t under the microscope of publicly traded stock prices. These companies focus on growing strong company brands. A 2012 McKinsey & Company survey found that strong brands outperformed weak brands by 20 percent. What did the customers of these business-to-business companies care about? Honesty, responsibility, specialized expertise, “fits my values” and leadership were top customer concerns.

We encourage investors to understand the business model in which they place their assets and confidence. A certain level of trust is required to do the right thing. Business is rarely black and white and as a result investors need a management team that is willing to hold strong to their beliefs and discipline rather than chase market whims.

A dashboard of financial indicators offers clues about a company’s future operations. Free cash flow is one our team’s favorite indicators. How much money is the business really making (net profit) and how much of that growth is management investing back into capital investment? It is possible that the management team of Volkswagen didn’t like the dashboard indicators and tried to manipulate earnings rather than face the regulators. Bad call.

Just like political change can be slow and painful, clear corporate leadership and managerial decision making is critical. An old adage says that to know what to do and not do it is no better than not knowing at all. When leaders focus on the short term – whether stock prices or political elections – we can expect the air to be filled with emissions from stinkin’ thinkin’.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column offset=”vc_hidden-lg vc_hidden-md vc_hidden-sm”][vc_widget_sidebar sidebar_id=”sidebar-main”][/vc_column][/vc_row]