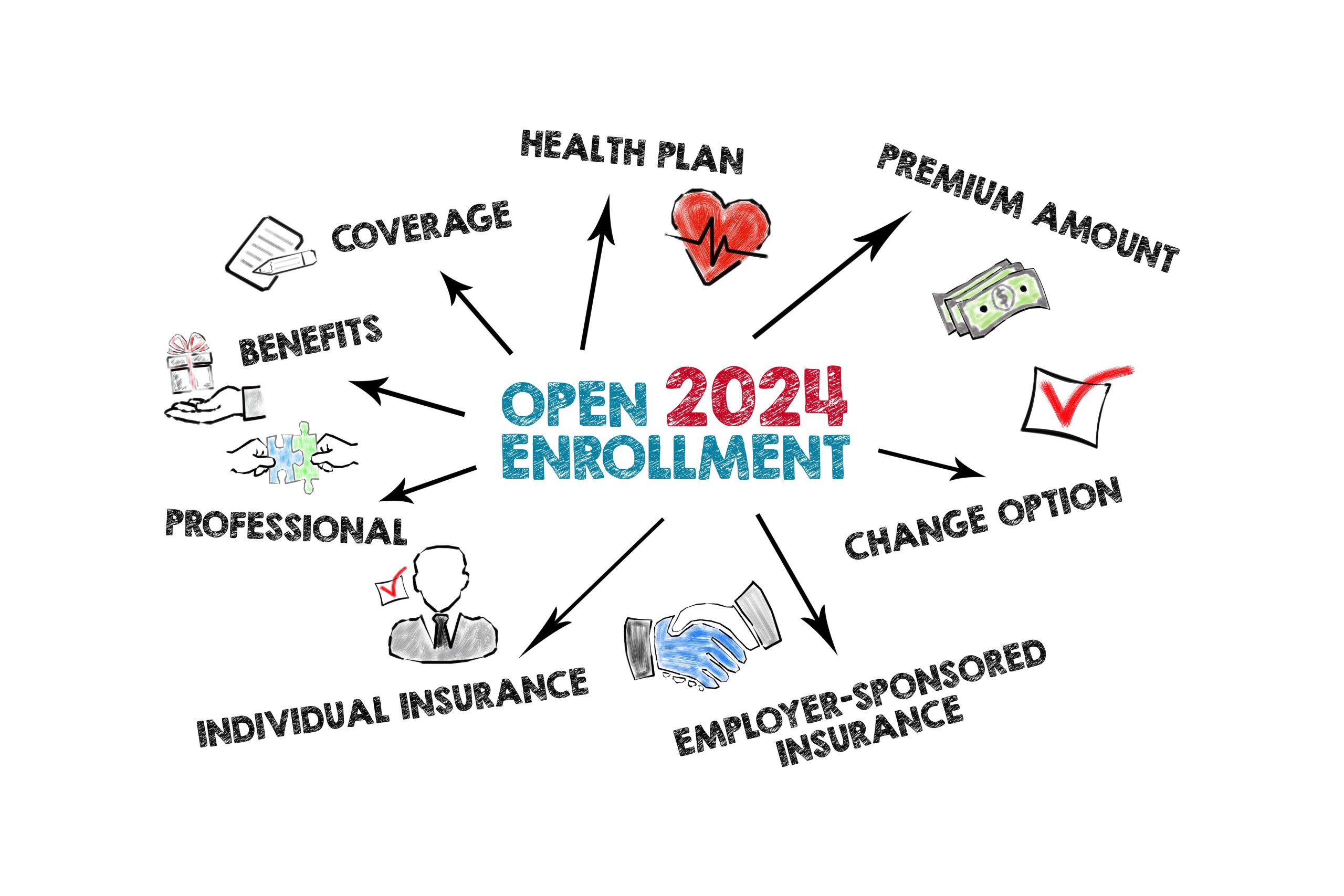

Open enrollment is a crucial period for employees when they can make changes to their insurance benefits. This annual event is a chance to assess and modify your coverage to better align with your current needs and life circumstances. To make the most of open enrollment, it's essential to consider several factors carefully. In this article, we'll explore the key considerations to keep in mind during open enrollment for insurance benefits.

Review Your Current Coverage:

The first step in open enrollment is to thoroughly review your existing insurance coverage. Take a close look at your health, dental, vision, life, and disability insurance policies. Consider factors like deductibles, copayments, and coverage limits. Make note of any areas where your current plan may be lacking or overcompensating. During open enrollment, employers typically provide a range of insurance options. Take the time to explore these alternatives and compare their benefits, premiums, and coverage. Pay close attention to any changes in plan offerings or benefits that might have occurred since the last open enrollment period.

Assess Your Healthcare Needs:

Your healthcare needs may change from year to year, so it's important to evaluate your anticipated medical expenses. Consider any upcoming surgeries, prescription medications, or treatments you or your family members may require. This assessment will help you select a plan that adequately covers your healthcare needs. If you have dependents, it's essential to consider their needs when selecting insurance benefits. Assess their healthcare requirements, including doctor visits, prescriptions, and any specialized care. Ensure that the chosen plan covers your family members' medical needs.

Understand Cost Considerations:

Cost is a significant factor in choosing insurance benefits. Evaluate the premiums, deductibles, and out-of-pocket expenses associated with each plan option. While a lower premium might seem appealing, it can result in higher out-of-pocket costs if you require frequent medical care. Weigh your potential expenses against your budget to make an informed decision.

Evaluate Additional Benefits:

Many insurance plans offer additional benefits beyond basic coverage. These may include wellness programs, telemedicine services, mental health support, and preventive care. Evaluate these extra offerings to determine if they align with your health and wellness goals.

Take Advantage of Tax-Advantaged Accounts:

Open enrollment is an excellent time to take advantage of tax-advantaged accounts like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). These accounts can help you save money on healthcare expenses by allowing you to contribute pre-tax dollars.

Open enrollment for insurance benefits is a critical annual event that requires careful consideration. By reviewing your current coverage, assessing your needs, exploring available options, and considering costs, you can make informed decisions that will protect your health and financial well-being. Seek professional guidance when necessary, and most importantly, “meet the enrollment” deadline to ensure you have the coverage you and your family need for the year ahead. Taking these steps will help you make the most of open enrollment and secure the insurance benefits that best fit your situation.

Financial Enhancement Group is an SEC Registered Investment Advisor. Securities offered through World Equity Group, Inc. Member FINRA/SIPC. Advisory services can be provided by Financial Enhancement Group (FEG) or World Equity Group. FEG and World Equity Group are separately owned and operated.