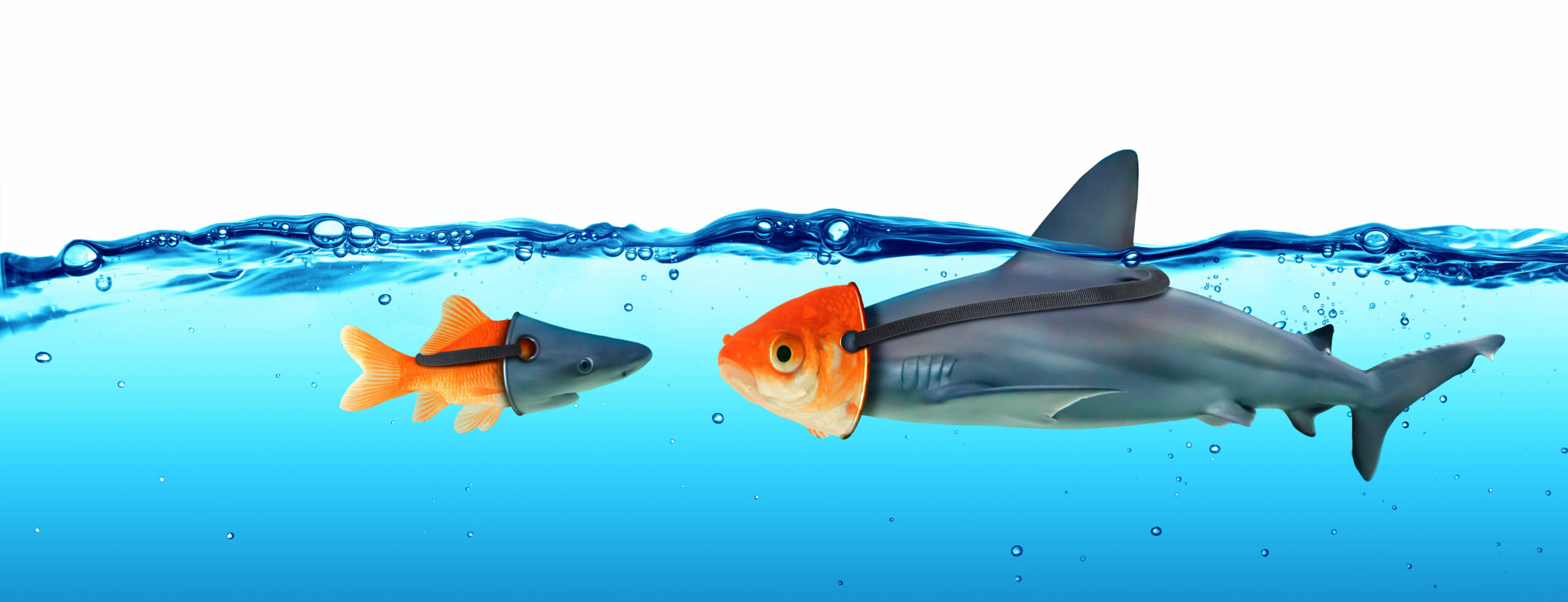

Character trust and competency trust are separate issues. Character trust is derived from believing a person has your best interest at heart and liking them. Competency trust exists when you believe they can do the task expected and required to meet stated objectives. A common mishap is allowing what we naturally understand – character trust – to override the necessity of competency trust.

I can count many people I like and trust – myself included. Though I have met individuals who say they don’t trust themselves not to cheat on a diet or go wild on Amazon, in general, people trust themselves. This, in my opinion, is why many people default to financial advisors they know personally, or even more often, allow themselves to do the job.

Competency trust is difficult to ascertain. How do you know if an advisor is doing the job that is expected and required of them? The natural default for when a person claims to be licensed and in the “industry” is for us to assume that they can do what they say they will do. When you buy a car, house, or even have surgery, after a reasonable feedback loop you can determine if you purchased the proverbial “lemon.” Retirement planning is best judged by the result, but what can you do along the way to ensure that the tasks and expectations are being met?

The first issue is process. Do you or your advisor have a documented process for retirement planning, annual tax planning, and a fluid investment strategy in a changing world? The process may not be perfect, but documentation is essential in removing emotional responses in challenging times.

The second consideration – is the process being followed? That may seem elementary, but often we hear people say that they have a process, and yet their actions indicate they have employed a “hope” strategy more than a thorough plan. You don’t need a four-inch owner’s manual, but you and your retirement deserve a documented “here is how we are going to address, alter, and measure this result.”

The third step is truly taking inventory of the process. Here is where most individuals tend to fail, in our opinion. If the plan is to have a certain amount of money at a given time, or a particular return, the plan is deemed to be working. Perhaps for investment planning that is enough, but how does it address retirement, tax planning, and legacy considerations?

Aaron Rheaume, CKA, Director of Financial Planning at the Financial Enhancement Group, says, “Having a solid relationship with your advisor is important, but that relationship won’t provide the retirement you deserve. The process, the detail, and the consistent monitoring are what is paramount for your best financial journey.”

We all have a fiduciary. Either you have hired a professional to treat your money like they would treat their own resources if they were in a similar situation – the layman’s definition of fiduciary – or you are acting on your own behalf. Do you have a documented process? Is it working? Not sure? Financial Enhancement Group fiduciaries can assist you in making that determination.

The Financial Enhancement Group is an SEC Registered Investment Advisor. Securities offered through World Equity Group, Inc. Member FINRA/SIPC. Advisory services can be provided by Financial Enhancement Group (FEG) or World Equity Group. FEG and World Equity Group are separately owned and operated.