Knowledge is power . . . or is it? It’s a common belief that the more data available, the better decisions we make. Despite this widely held belief, almost every study debunks that notion.

If you receive more information on a topic you understand and are passionate about, the data can be helpful and sometimes vital. However, getting more data on topics you don’t understand can lead to bad conclusions. We firmly believe that good decisions incorporate three elements: knowledge about a given topic, good information, and the wisdom or opportunity to apply the information. Missing any of these three elements can result in poor decisions.

We recently reviewed a study released by Stanford University and other sources. Stanford is a respected institution. After teaching seven years as an Adjunct Professor at Purdue, I respected Stanford’s clear definition of the sample group. But that doesn’t mean a news service looking for a compelling headline understood or even cared about the sample group, or how readers would interpret the headline.

The headline and select parts of the study stated that working six months longer could be as impactful for a person’s retirement as saving another 1% of their income for 30 years. If that statement were valid, it would be a life saver for many families with little or no savings and a proper Social Security strategy.

As I read the article, the “this is very wrong” indicator in my belly screamed an alert. Thirty years in the financial industry, CFP education and my experience as an academic at Purdue all helped me sense the statement was bad data. Without full understanding, the data could be harmful for the casual reader and potentially devastating for those without the wisdom to apply the data. But the data was from Stanford. Could such an institution really be wrong?

The study authors were not wrong. However, people had to read almost to the end of the article before coming across a protective clue. Before describing the sample group, the author merely pointed out that Social Security made up 84% of income and working an additional six months could be a game changer. Very few people reading this financial article or any variation of its headline, are anywhere near having Social Security make up 84% of their retirement income. A much closer estimate is 30-45%.

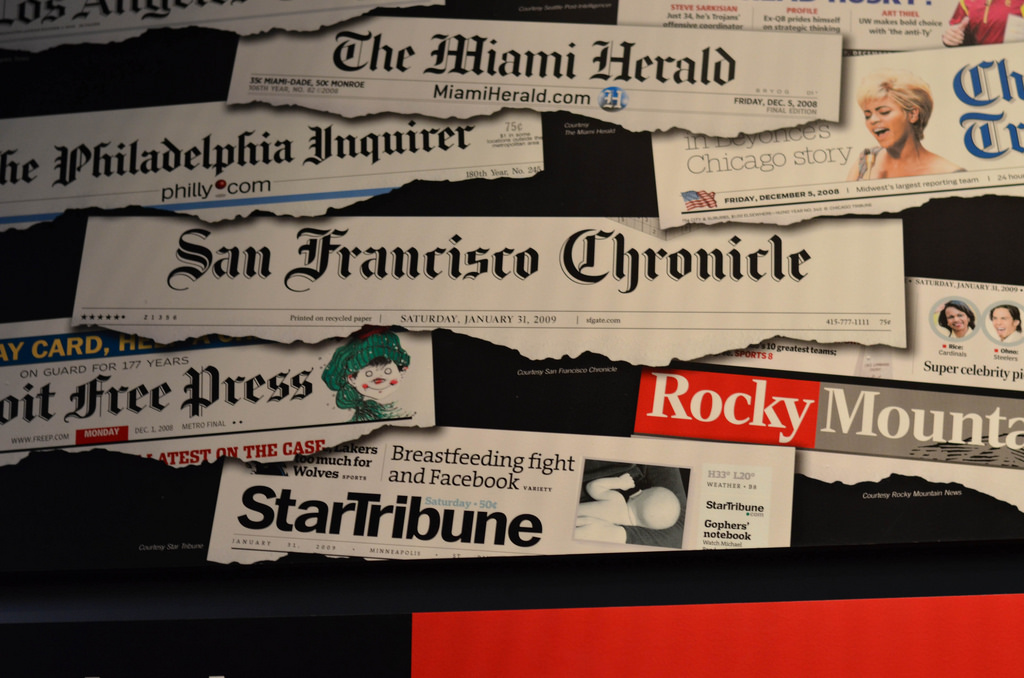

Headlines are “reader bait” and the article provided a hopeful headline. The study is important and provided good insight for Americans on the lower end of the income scale. The challenge is that the data alone, without context, and without the necessary experience or wisdom to understand it, could be dangerously misapplied.

By nature, we seek solutions for our problems and look for evidence to support what we want to believe is true. The authors of headlines know this and structure their stories to grab your attention. Read with discernment and always, consider the data.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer.