[vc_row][vc_column width=”1/4″ offset=”vc_hidden-xs”][vc_widget_sidebar sidebar_id=”sidebar-main”][/vc_column][vc_column width=”3/4″][vc_column_text]

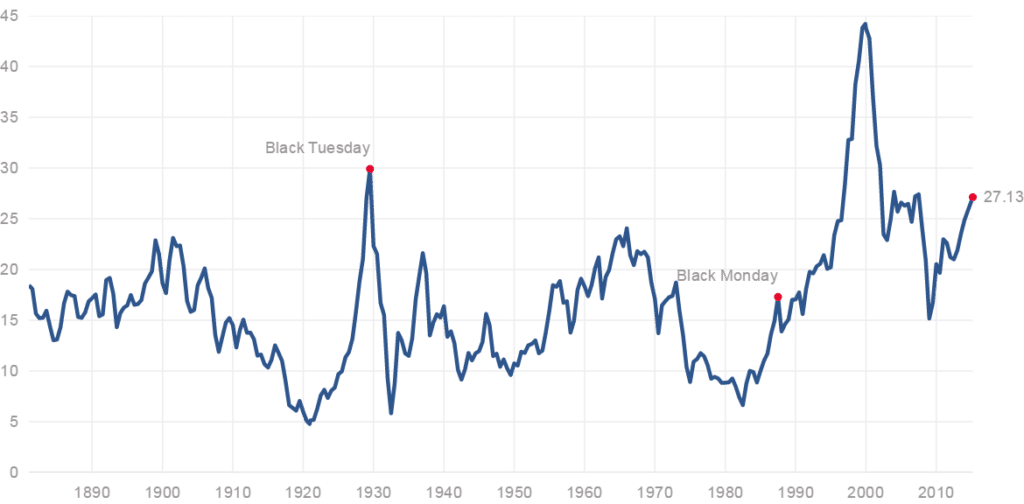

The month of February ushered in two key valuation milestones for the market (S&P 500). First, the Shiller Cyclically Adjusted Price to Earnings (CAPE) ratio for the S&P 500 passed through its 2007 high of 27.5. Only the 1929 and 2000 colossal bubbles have taken the ratio onto even higher levels. Indeed, the CAPE ratio has recently received some very legitimate criticisms. Mostly though, those criticisms can be boiled down to a pretty simple notion: the history of this data – prior to 2001– should be shifted upward when comparing modern era (post 2001) values to history.

The reasoning for this shift in analysis is due to FAS 142 which significantly changed the way earnings (specifically goodwill amortization) were accounted for under GAAP principles. Suffice it to say, earnings would have been reported as lower over time if FAS 142 were in place during that time, thereby making the CAPE higher. All of this is to say that more time in history would likely have been spent near these higher 20’s levels. But it doesn't really change the fact though those readings near the higher end of a 10 year range have seldom been good times to invest.

The other key valuation metric hit is a 10 year high in the price to forward earnings ratio (at 17.1). The combination of the February rebound in stock prices and fast drop in earnings outlooks by companies have worked to push this to a new high. Naturally, the key question to come from these heightened weather conditions is whether you should simply park your car in the garage so to speak and stay put? We would still answer this as a no. Fundamentally, we say no because our investment philosophy is to never be all in or all out of an asset class. But we would also remark that to be fair, valuation metrics have been on the higher edge now for a while before moving onto these whole new levels. By the same token, it isn’t meaningless data either. In fact, valuation is one input into our FEG Risk Barometer. Should the market lose the other “legs” of our Risk Barometer that are currently positive and market loses its trend, larger than usual sell tickets are likely to soon follow.

Withdrawal Rate

Another thought process we encourage based on these very high valuations is to review is the concept of a withdrawal rate. A 4% rate has long been used to as the standard rate for how much can be withdrawn from a balanced portfolio and not risk a reduction in principle over a long period of time. But, we have to at least ponder being at a stage that the studies producing that 4% number never faced: very high valuation levels in U.S. equities coupled with 0% short-term interest rates. We’re not prepared to say this 4% rate should be thrown out the window, but it does warrant more attention than usual. A simple way to think about this is to consider that the yield on the S&P 500 and the Barclay's Aggregate Bond are both around 2%.

That leaves a tremendous burden on growth to battle volatility and sustain the withdrawals over time.What might you do? If you started taking a withdrawal of 4% of your capital a few years ago, might avoid ratcheting that income stream up. Instead, possibily enjoy the nice cushion that has built up. More importantly, if you are freshly taking withdrawals – consider starting out with a smaller percentage, say 3% if you can. Again, there is no reason to run for the hills – but we will especially be required to be nimble in asset allocation. International stocks aren’t nearly as burdened with high valuations and at some point, may prove quite valuable in supporting the income stream. A healthy dose of alpha from active investment selection would also come in handy, alpha that has been notably and painfully absent from large swaths of active money managers in recent years.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column offset=”vc_hidden-lg vc_hidden-md vc_hidden-sm”][vc_widget_sidebar sidebar_id=”sidebar-main”][/vc_column][/vc_row]